Operationalizing Outbound Part 2: Building the List

Read time: 8 minutesExec Summary

- My secret to success in sales has always been targeting

- Target lists remove 80% of heavy lifting in outbound sales

- This helps increase SDR/AE focus and improve LTV:CAC

- This newsletter series covers every way to optimize outbound

- Part 1: Capacity Planning

- Part 2: Building the List

- Part 3: Creating Your Sequences

I have never considered myself a great salesperson…

- I talk too much and am not great at discovery

- I don’t have the best pitch in the world

- I’ve never been the most charismatic

- I’ve never been the life of the party

Despite that, I’ve been very successful in sales:

- Top 10 Producer in 2 Fortune 500 Companies

- First AE in multiple startups, full cycle, open to close

- Bootstrapped my own business with $200 to 7 figures

My secret has always been targeting.

With a carefully curated list of companies to go after, 80% of the heavy lifting in outbound sales is done for you.

In last week’s newsletter we discussed why capacity planning is a crucial first step to determine the ideal size of your target list (and exactly how to do it).

Now that we understand the true capacity of our SDRs and AEs, it’s time to figure out:

- Who goes on their target list

- And how we segment it

By the end, you should have a target list that allows your reps to:

- Focus on the best possible accounts only

- Send messaging that’s tailored to specific ICPs/Personas

- Without having to create new messaging for each contact

The result: higher reply rates, more pipeline, and lower CAC.

Gathering Data

Creating your target list starts with collecting as much data as you can:

- Look at your best customers and go deep

- How can you describe them in great detail?

2. What are your Buyer Personas?

- Who are the key stakeholders in your best accounts?

- How can you describe them in great detail?

3. What firmographic data describes your ICP?

- Eg; Revenue, employee headcount, industry, etc.

- These are just examples though

- Go much deeper than this

4. What tech are they currently using?

5. What’s their past engagement with marketing?

- Webinars attended, whitepapers downloaded, etc

- Ideally we have out Customer Journey mapped out

6. What accounts are showing intent in the market?

We can get this data through tools like Zoominfo as well as our past sales and marketing interactions. We can also layer on third-party intent data. The more data we have, the better we can target.

However, the more data we have, the more difficult the analytics exercise. We have to balance the desire to build the perfect list with the resources and tools we have.

That said, this is where AI is starting to show real promise for the future.

The goal is to aggregate all of this data together and do the best we can with whatever resources we have.

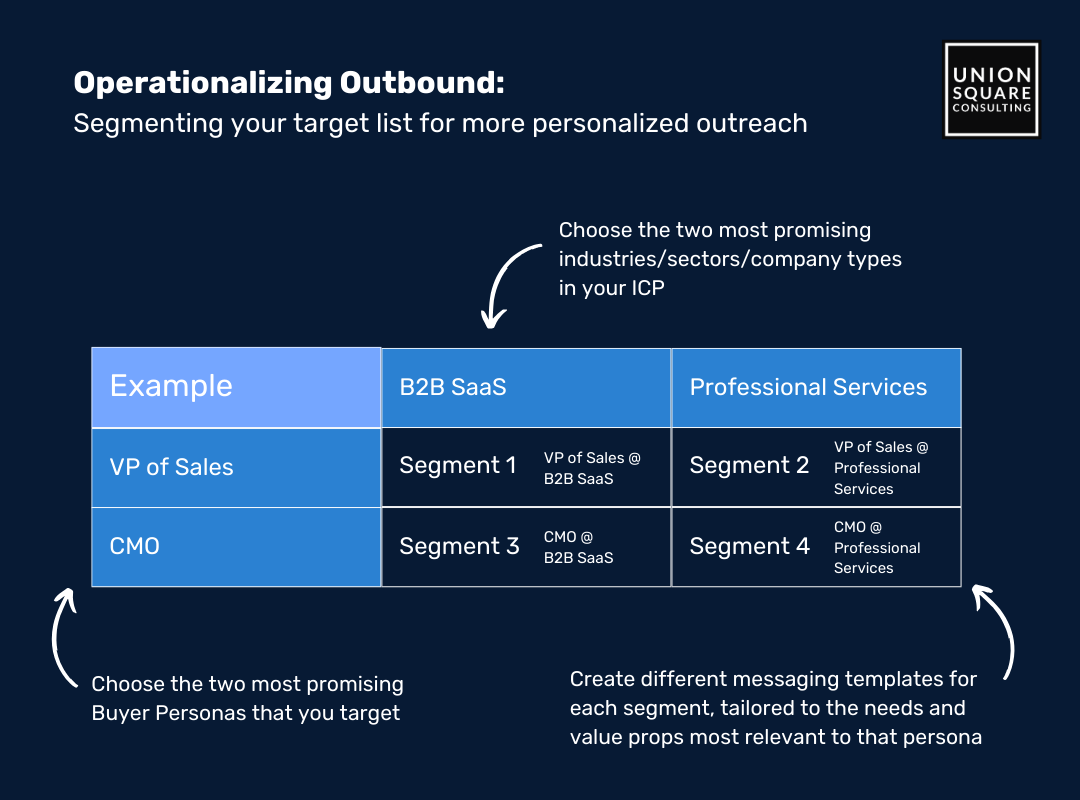

Segmenting Your List

Breaking your list into segments gives your reps the ability to talk to a large number of contacts with similar messaging – and have that messaging resonate deeply with every single one of them.

Ideally, you want one segment for each industry and buyer persona. You might have one segment for VPs of Sales in B2B SaaS. Another for CMOs in B2B SaaS. Another for VPs of Sales in Professional Services and another for CMOs in Professional Services.

Many outbound experts say the ideal amount of personalization for messaging is only 25% (often the intro). The other 75% can be a template for your value proposition.

That 75% should still be relevant to the segment you’re messaging, though.

The types of segments you create (and how many of them) will be dependent on your market and the resources on your team.

A company like Salesforce, for example, could have hundreds of segments. A smaller scale-up with a team of 5 SDRs might want to focus on ~4 of their best segments.

We recommend choosing the two most promising industries/sectors/company types and two personas from each, then creating four segments out of a cross section of them.

If you’ve properly defined your ICP, these segments should make up all or most of the contacts on your list. The contacts that don’t fit should be set aside – they didn’t make the cut.

With a segmented list, your reps can focus on one group at a time instead of bouncing between vastly different contacts with different messaging needs for every activity. This will be important for Part 3, Creating Your Sequences!

We’re not yet done with your list though. Now it’s time to score and tier it.

Defining Your Scoring Criteria

Scoring your accounts will give you an idea of their relative value.

There are no hard rules on what criteria you should be scoring against.

Decide on the variables that matter to your company and that signify a propensity to buy.

For example, if your best customers came from a specific industry, you might want to make that one of the variables you focus on.

Other variables might be:

- Company size

- Their subsector

- The tech they use

- Latest funding series

- Etc.

Again, though, these are just examples – you can and should go deeper.

Get as specific as your data, tools, and resources will allow. Then you can set a score for each variable and the overall score for an account.

The goal here is to use analytics to select the best accounts that make it on your tight prospecting list. Often companies just go by industry and company size and call it a day. This is usually not enough and will result in your reps targeting the largest accounts while missing the best prospects.

Tiering Your Accounts

A simple way to tier your accounts is to line them up based on their score.

Many companies will only have enough data to do a basic level of tiering – and that’s ok. Any push in the right direction is going to be beneficial. Funding events are often a big factor here so if you want to keep it simple, those that got funding in the past few months might make it to Tier 1 while others go to a Tier 2 or Tier 3, as an example.

If you happen to have enough historical sales data to predict what each prospect might buy or how much they might spend, you can take your tiering one step further.

For example, let’s say your current customers with less than 50 employees spend $20k per year on average. The customers that have more than 50 employees spend $45k per year on average.

Multiplying their score by the amount you expect them to buy and using the resulting number to tier them (rather than the score alone) can give you a more accurate idea of each account’s opportunity value.

Continuing with our example, if you’re scoring accounts out of 100 and an account has a score of 90 but they’re likely to spend $20k, the expected value of the account is $18k. If another account has a score of 70 but they’re likely to spend $45k, their expected value is $31k.

Doing this, you should be able to find the best 1,000 contacts to go after (or whatever your capacity is).

Create Tiers 1, 2 and 3

Once you have a score, you and/or your sales reps can separate these into Tiers 1, 2, and 3.

Tier 1 will typically be a small set of your best accounts where reps will invest significant time to create highly personalized and well researched messaging. This is often the top 10 or top 10% of accounts.

Tier 3 will typically be the bottom half or so of accounts where reps will invest far less time to research and personalize each activity. Tier 3 accounts are often great for practice as they offer less opportunity for revenue but more opportunity for reps to try new approaches and get feedback.

Tier 2 is in the middle, often about 40% of your accounts, where reps will do some research and personalization but less than they would for Tier 1s.

RevOps can start this process via the data analytics exercise described above, but there’s an inflection point once you get to account by account research. As reps research their accounts, visit websites and make calls, they start to form an opinion about the accounts.

For example, they start researching a great account and read about a massive layoff last month. This could turn a Tier 1 into a Tier 3 (or a Tier 3 into a Tier 1 depending on your ICP), so it’s important that reps tier their accounts on a regular basis.

What to Do with Your New Outbound Target List?

Now you have a list of your best-fit prospects, tiered from highest to lowest opportunity value and within your reps’ capacity.

The final step is to build a high-converting sequence for each segment.

Stay tuned for next week’s newsletter where we show you how!

When you’re ready, here’s how we can help:

Get a Free 1:1 Revenue Efficiency Workshop

Get one of our Senior Revenue Strategists to yourself for 1 hour and leave with a plan to increase the money-making power of your go-to-market operations.

Hire Us!

Bring us on as your Strategic RevOps Team and realize the growth potential of your revenue engine. There are 3 ways to work with us.

Get more tips like these, sent right to your inbox.

Subscribe for fresh, relevant revenue growth tips delivered every week.