2024 Predictions For B2B SaaS Revenue Growth

Read time: 9 minutesHas the 2-year decline in SaaS growth finally ended?

Are things going to look better in 2024?

SaaS is entering an economic era that no one has ever worked through in this industry before.

The old playbooks are out the window. New ones are being created as we speak. In fact, this newsletter might be the first time you hear about these new growth tactics in a post-crash world.

But to understand what 2024 might bring – and how to prepare for it – first we have to look at what brought us to this point. (Feel free to skip down to “What to Expect in 2024” if you already know this stuff.)

The Good, The Bad, and The SVB

Back in 2021, the economy was purring along and interest rates had been low for a while.

The strategy at the time was; raise as much money as you can now, grow the company, then that growth will fix all of your problems later. “Growth At All Costs.”

During this time, CAC reached an equilibrium. You spent more, but you also sold more. It’s not entirely profitable, but that didn’t matter because you could always raise more money on the cheap. The growth is what mattered.

That’s the world that the business model for SaaS matured in. And that was the world where most of the best practices around revenue generation were made. Grow, grow, grow – and worry about profitability later.

The, two things happened between Q1 2022 and Q1 2023:

- The Federal Reserve hiked interest rates to combat inflation

- In a domino effect, Silicon Valley Bank collapsed

The economy was slowing down, companies were still burning through cash while selling less, venture capital was drying up, and there was pressure to not run out of cash –

Then BOOM.

The largest money lender in the tech industry collapses almost overnight.

Cue mass layoffs, cutting expenses, anything to get to profitability zero rapidly because you couldn’t rely on your “credit card” anymore.

Sounds apocalyptic – and many people thought it was.

A Course Correction, Not a Downturn

By Q2 2023, everyone who was still standing was back to running at profitability zero.

But after months and months of burning cash while in the negatives, growth is again at the front of everyone’s mind.

Except now, you can’t grow at a loss anymore, because borrowing money is too expensive. In Q2 2020, interest rates were at 1.5%. From 2020 to 2022 they were basically zero. As of Q4 2023, interest rates have skyrocketed to above 5%. Even though we’ve reached a new equilibrium, the game has changed completely.

There’s been a paradigm shift in the way companies must tackle growth. We went from “grow at all costs” to “grow as fast as you can without losing any money”.

Nobody in SaaS has ever worked in an environment like what we’re now dealing with.

Yet the need for VCs remains as high as ever. Apart from critical investments (which you’ll need if you hope to compete with other venture-backed companies), VCs come with advisors and connections that can make or break a business.

So how should you navigate the coming year and still come out on top?

What You Should Expect in 2024

Both the banks that lend you money and the investors that give you money want a lot in return. And when they do cut a check, it’s going to be a smaller one.

You can no longer run your business below profitability for a long time in the hopes that you’ll be profitable later. And remember that EBITDA/profitability zero is often still working at a loss from a cashflow perspective. The result is a precarious balancing act between managing debt, cashflow, and growth.

Because of that, here are my predictions and recommendations for the next 18 months…

Maintaining Cashflow: Stay Cashflow Positive Instead of “Growth at All Costs”

Simply monitoring our value metrics or whether we have a good LTV:CAC is no longer enough. Now, we also need to pay attention to structuring our operations around the idea of more closely monitoring our cashflow.

During the pocket of time between spending money on marketing and sales, to getting a customer, to cashing the invoice, tons of money has been burned with $0 in cash coming in.

If you try to grow fast in an environment where you’re not getting cash in, but you’re spending it hand over fist, when cash is super expensive, you’re setting your business up for collapse.

This is what it means when we say “growth at all costs is dead”.

The new era of SaaS is “growth within cashflow”.

Tighten your cashflow collection periods to help with this. For example:

- Change collection periods from net 45 to net 30

- Request upfront yearly payments instead of quarterly

- Wait until money is collected before paying out commissions

However, expect pushback from customers when trying to set these terms. Some negotiating might have to come into play. Offering discounts to get better payment terms might become the norm as SaaS businesses become more concerned about making payroll than the promise of making more money a year from now.

Risk Aversion: Every Investment Must Earn Its Place

We’re going to see a lot more proof of concept happening before making big investment decisions. More companies will be doing onesie, twosie kind of hires as opposed to classes of 25 people getting hired in a summer.

Mistakes are more costly than ever, so everyone is going to be trying incremental or low-risk, dipping-your-toe-in-the-water initiatives.

A “Land and Expand” approach to your GTM strategy will help you meet customers where they are, give your product the chance to prove itself, and give yourself the chance to earn more revenue.

To apply “Land and Expand”, simply:

- Close a new logo sale on a smaller, less intimidating deal

- Once they are an existing customer, it will be easier to upsell them down the line

“Land and Expand” gives you the chance to create some cashflow and build rapport on an opportunity that would otherwise not be comfortable with/ready for your full offering.

Plus, according to a study by MARKINBLOG, you’re 3 to 17 times more likely to sell to an existing customer vs. a new customer.

Opt-Out Strategies: Lean Towards Auto-Renewals

We’re all going to be looking for quicker payback periods on all investments that we make, with more options to opt-out when the value isn’t adding up. And that goes for both us as well as our customers.

I don’t recommend giving customers more opt-out options in their contracts, but be aware that people will be looking for it (and now you know why).

To give your customers what they want, while still setting yourself up for success, I recommend implementing auto renewals.

This way, when the end of your customer’s contract comes up, the assumption is that they will continue using your product unless they specifically choose to quit. Versus assuming the end of the engagement and requiring your customer to opt-in again.

Mechanically, they’re getting the same freedom, but the framing makes a huge difference. You want the path of least resistance to be retention, not churn.

Balancing Growth and Profitability: It’s Mandatory

Profitability is going to be king for a while yet.

During the course of 2024, I expect interest rates to start dropping and the cost of capital to decrease, but no one knows when. Until they drop significantly, running profitability zero (or higher) while trying to grow as fast as you can is the name of the game.

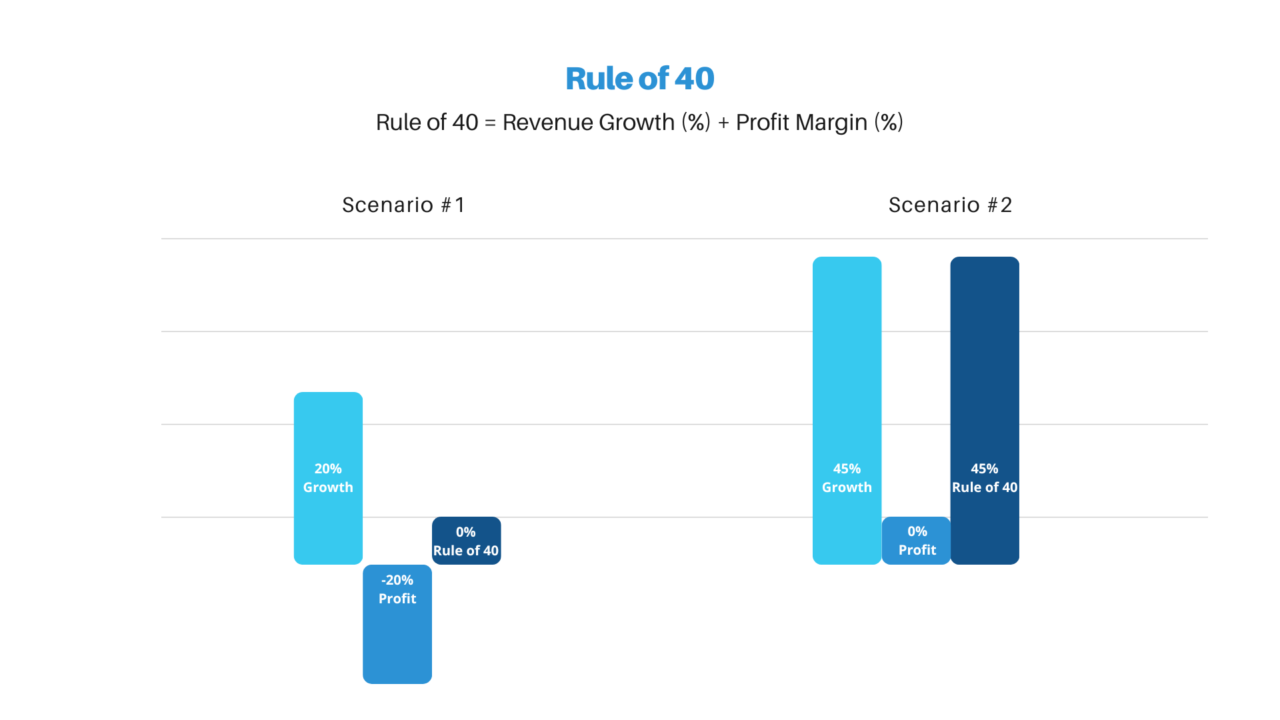

The “game”, as you likely know, is getting the highest “Rule of 40” number that you can achieve.

If you need a quick refresher, the Rule of 40 is the idea that SaaS companies must have a combined growth rate and profit margin of 40% or more to be considered sustainably profitable. Falling below 40% means your company valuation is in trouble.

To Wrap Things Up…

2024 has the potential to be a year of solid, sustainable, and consistent growth for companies that are able to adapt to the demands of the new economy. And combined with the game-changing leaps in generative AI (which is a topic for next week’s newsletter), I believe it will be the year that separates the ones who can from the ones who cannot.

If you’re concerned about staying profitable in the new “growth within cashflow” era, consider working with a RevOps strategist who understands the new playbook.

Yep, I’m talking about me. This is shameless self promotion.

You can work directly with me by:

- Booking a free revenue efficiency workshop

- Weekly 1-on-1 coaching (at a dip-your-toe, no brainer cost)

- Or contacting us to receive full-service, done-for-you Strategic RevOps

TL;DR

- “Growth at all costs” was only possible with cheap and easy capital

- It’s now significantly more expensive to raise capital or borrow money

- Companies can no longer rely on their “credit card” to keep them afloat

- Companies must grow while maintaining profitability and positive cash flow

- To succeed at this, I recommend:

- Tightening cashflow collection periods

- Waiting until cash collection to pay commission

- Applying “Land and Expand” to your GTM strategy

- Setting up auto-renewals to make retention seamless

- Maintain course until interest rates drop significantly.

- This is the only way to achieve the highest “Rule of 40” number in 2024

When you’re ready, here’s how we can help:

Get a Free 1:1 Revenue Efficiency Workshop

Get one of our Senior Revenue Strategists to yourself for 1 hour and leave with a plan to increase the money-making power of your go-to-market operations.

Hire Us!

Bring us on as your Strategic RevOps Team and realize the growth potential of your revenue engine. There are 3 ways to work with us.

Get more tips like these, sent right to your inbox.

Subscribe for fresh, relevant revenue growth tips delivered every week.