The Real ROI of RevOps

Read time: 8 minutesWhere’s the ROI in RevOps? If you said revenue growth, you’re missing something big!

The purpose of RevOps isn’t just to drive revenue growth. It’s to maximize the Enterprise Value of the company. Any company that asks RevOps to focus solely on revenue is causing serious damage to its business.

I regularly see people pushing Revenue Operations to get more revenue and nothing else. I think that’s wrong, or at least short-sighted.

The “smart money” is already agreeing with me. They’ve moved past this narrative. I’ll point to one thing to prove that. Revenue Operations is the most in-demand job on LinkedIn right now despite the fact we’re in a low-growth economy. This is worth celebrating!

We as Revenue Operations professionals should see our remit differently.

The Label is Misleading

It’s easy to understand why Revenue Operations are often only thought of solely as revenue growth. Heck, it’s in the title. RevOps often reports to the Chief Revenue Officer. “Driving Revenue Growth” is sexy and exciting.

Unfortunately, this narrative limits the remit of RevOps and backs the company into a corner.

It’s not wrong, though, just incomplete. RevOps is justifiable beyond revenue growth and without it, you are dooming your entire company to failure. Having RevOps today is table stakes. You wouldn’t run a company without an adequate accounting team, legal staff, or other critical operational resources. They don’t drive revenue growth but you know you can’t build a company without them. Revenue Operations are equally critical to a modern B2B SaaS company.

So, how should we look at this instead?

Revenue Growth VS. Profitability

First, Revenue Operations leaders should focus on the Enterprise Value of the company and understand that Revenue Growth is just one element of Enterprise Value. It happens to be the most impactful lever. However, Revenue Operations is the steward of nearly every variable that goes into company Valuation. Unfortunately, nobody talks about this.

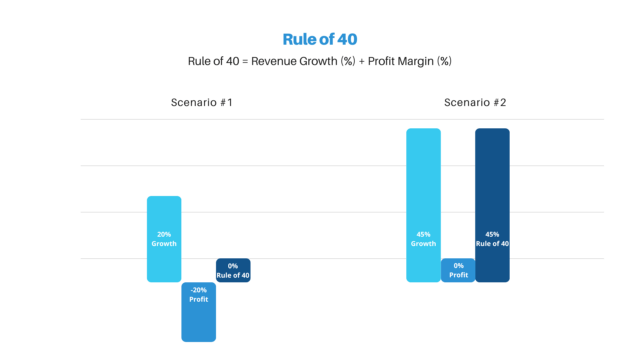

To illustrate this, let’s look at the famous “Rule of 40” which states that in a healthy B2B SaaS Startup:

Revenue Growth (%) + Profit Margin (%) >= 40.

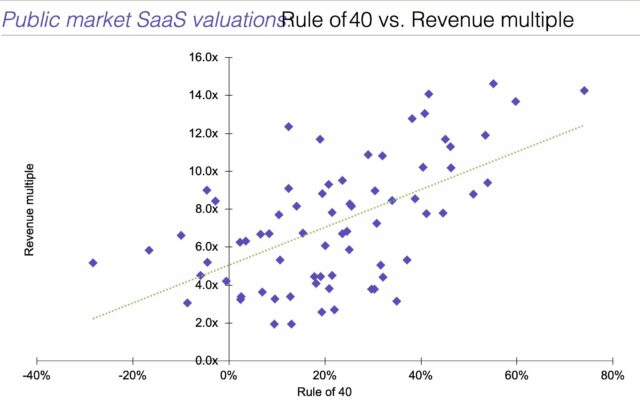

Here’s what’s important about this. Take a look at the chart below. If the Rule of 40 number is 0% for a startup, each $1 of additional revenue increases the Enterprise Value by about $5 (5X).

However, if you can improve the Rule of 40 Number you get an Exponential Return.

(This chart is from Aventis Advisors and S&P Capital IQ covering Public Companies. It’s not a perfect representation of small startups but it demonstrates the effect well enough.)

Let’s show this exponential return in a simple example. Let’s say that last year’s revenue was $8.3 million and grew to $10 million, with $12 million in costs. Revenue Growth is 20% and Profit Margin is -20%. The Rule of 40 Number is 0% so the multiple is about 5X Revenue.

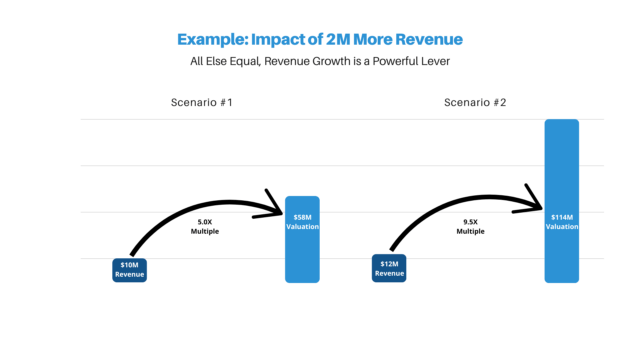

Now, imagine that instead of growing to $10 million in revenue, we found a way to grow to $12 million in revenue without increased spending, but creating a more efficient Revenue Engine with the same sales and marketing team. Revenue Growth from $8.3 million to $12 million is now 45% and we’re now breaking even so our Profit Margin is 0%. The Rule of 40 number is now 45%!

We’ve increased revenue by an extra $2 million, but we have also increased our Valuation Multiple from about 5X to about 9.5X. This is the exponential return!

In this example, every $1 of additional revenue, without additional Customer Acquisition Cost (CAC), increases the Enterprise Value by $32! This is a bit simplistic but it shows that investors consider far more than just revenue growth in valuation.

Another way to look at this is to ask if the revenue you’re generating is increasing or decreasing the company valuation. If your organization gets above 40, then your company value can go up exponentially, as we’ve seen.

In the current economy, however, multiples are down and revenue growth is a lot more difficult. It’s harder to land a customer now and the Customer Acquisition Cost (CAC) has increased. Raising capital to fund this cost is harder and more expensive. So, it makes sense to work on improving profitability. When funding is expensive, Revenue Efficiency is king.

The ROI on improving margins, even without revenue growth, is still ENORMOUS. All else equal, a dollar in extra profit can return 12x in added Valuation. (We’ll spare you the math this time.) The great news is that it costs nothing but the work of the RevOps team to acquire. That’s why we are seeing demand for RevOps skyrocketing even in a lower growth environment.

RevOps is uniquely positioned to impact both Revenue Growth and Profitability, in good times and bad, by finding efficiencies in GTM processes.

Scalability

Secondly, investors don’t want revenue and profitability today. They want (and need) 10X tomorrow! They want scalability and that relies on building an efficient operation for future growth.

The challenge here is thinking long-term. It’s tempting to focus on revenue growth today and ignore the needs of the company tomorrow. For example, every startup has a Revenue Tech Stack but there is constant conflict between short-term and long-term needs. Patching things together quickly may save a little time and money but it creates exponentially growing complexity that will hamstring the company in the future.

A Revenue Tech Stack without Revenue Operations eventually just becomes a liability more than an asset.

If you ignore this your company will plateau. This most likely comes when you can’t outgrow your churn. The bucket springs a leak, you don’t have visibility to see breakdowns, and people start fighting. You can go from growth to dying in a few months. As you survey the wreckage, you’ll wonder how it happened. The answer is you didn’t hire and empower a RevOps team and you now have a mess that will take time to clean up, from bad systems to poor processes to people that got accustomed to the way things have worked.

Market Position

Finally, let’s get to what really matters, Market Position. You will not IPO, become a unicorn, or get bought by Google for a billion dollars if you aren’t one of the top players in your market.

If you are in a market long enough, in a growth phase as an industry, it’s a race against the clock to fill one of the top two spots in that market.

Without government or regulatory intervention, every market evolves to two major players at scale, 40% and 30% of the market, and everyone else gets beaten. (Pepsi/Coke, Boeing/Airbus, Microsoft/Apple, etc.) If you grow faster than everyone else, you will win the race. If you don’t then you won’t be able to keep up.

Investors are betting on who will win out in the long term. That’s why they pay millions and billions to acquire companies. That’s why most companies spend every last dime they have and more on growth.

If the industry is growing at 20% and you are growing at 10%, sayonara. You’ll get passed, your competitors will get entrenched, and their size/funding/brand advantage will win out. In this case, Revenue growth needs to be a focus of the RevOps team. You need to get things above the 20%.

If your market is not growing or growing slowly, like today, then the dynamics change. More revenue is always good, and to quote big Tom Callahan from Tommy Boy, “if you ain’t growing, you’re dying, there ain’t no third direction”.

However, revenue won ineffectively, unprofitably, and likely-to-churn, is worse than not winning it at all. In other words, winning a customer just to churn them tomorrow doesn’t help you win market share. Doing bad deals dooms you in all cases, but no more than when you’ve slowed. You do need to grow, but that means you can’t blow what little cash you have on inefficiencies and bad dealmaking.

In both growth scenarios, fast or slow, the organization with a competent Revenue Operations team will win out vs ones without one; by deploying capital efficiently, building scalability, and yes, creating the support structure for revenue growth.

SUMMARY

- RevOps’ ultimate goal is Maximizing Enterprise Value

- Revenue Growth is just one way to do that

- Customer Acquisition Cost is increasing

- Funding is scarce and expensive right now

- So Revenue Efficiency should be the focus

- Improving Revenue Efficiency generates exponential value

- Scalability is another important factor to Enterprise Value

- Ultimately, winning a top position in the market is everything

When you’re ready, here’s how we can help:

Get a Free 1:1 Revenue Efficiency Workshop

Get one of our Senior Revenue Strategists to yourself for 1 hour and leave with a plan to increase the money-making power of your go-to-market operations.

Hire Us!

Bring us on as your Strategic RevOps Team and realize the growth potential of your revenue engine. There are 3 ways to work with us.

Get more tips like these, sent right to your inbox.

Subscribe for fresh, relevant revenue growth tips delivered every week.