Where to Start in GTM and Ops

Read time: 9 minutesI’ve been doing some deep and critical work with 3 different CROs in the past month. All new to their role, all in B2B SaaS companies, all sharing similar challenges – stuff we see again and again at USC.

They’ve inherited poor processes, limited visibility into their GTM Engine, and a need to get some quick wins on the board.

Here’s a rundown of each case:

Company 1:

- $100M B2B SaaS company

- Primarily an inbound motion

- Doesn’t know how many leads they have

- Doesn’t know how much qualified pipeline they have

- No standard process for inbound or pipeline management

- CRO wants to fix these issues as soon as possible

Company 2:

- $30M B2B SaaS Company

- Primarily an outbound motion

- Doesn’t know what accounts to target

- Doesn’t know how much qualified pipeline they have

- No standard process for inbound or pipeline management

- CRO wants to fix these issues as soon as possible

Company 3:

- $50M B2B SaaS company

- AEs cover inbound, outbound and expansion

- Hiring 16 new SMB AEs, doesn’t know territories yet

- Has SMB, MM, ENT and INTL sales teams covering all

- Doesn’t know how many inbound leads they’ve generated

- Doesn’t know how much pipeline they’ve generated from outbound

- Doesn’t know how much pipeline they can expect from existing customers

- CRO wants to fix these issues as soon as possible

Where do they start?

In this newsletter I’m going to break down how we approach these challenges and how we prioritize the work when doing GTM Design and RevOps.

There’s a Common Thread: Lack of Process

All three of these companies share some very common threads. They all have a new CRO that just stepped in and, as they looked around, they realized there was no real process. They’re not 100% clear on their ICP and buyer personas, lead qualification and routing, the outbound prospecting process, pipeline qualification and management, or how to identify and work expansion opportunities.

Each of these companies have a different mix of GTM strategies, channels, and teams, but they all have one thing in common: Each person on their team does things their own way. There’s no standard process.

As a result, these CROs can’t trust their reporting. They have no visibility into their business. They have no way to know if they are on track to hit their goals or what’s working well in the business and what’s not.

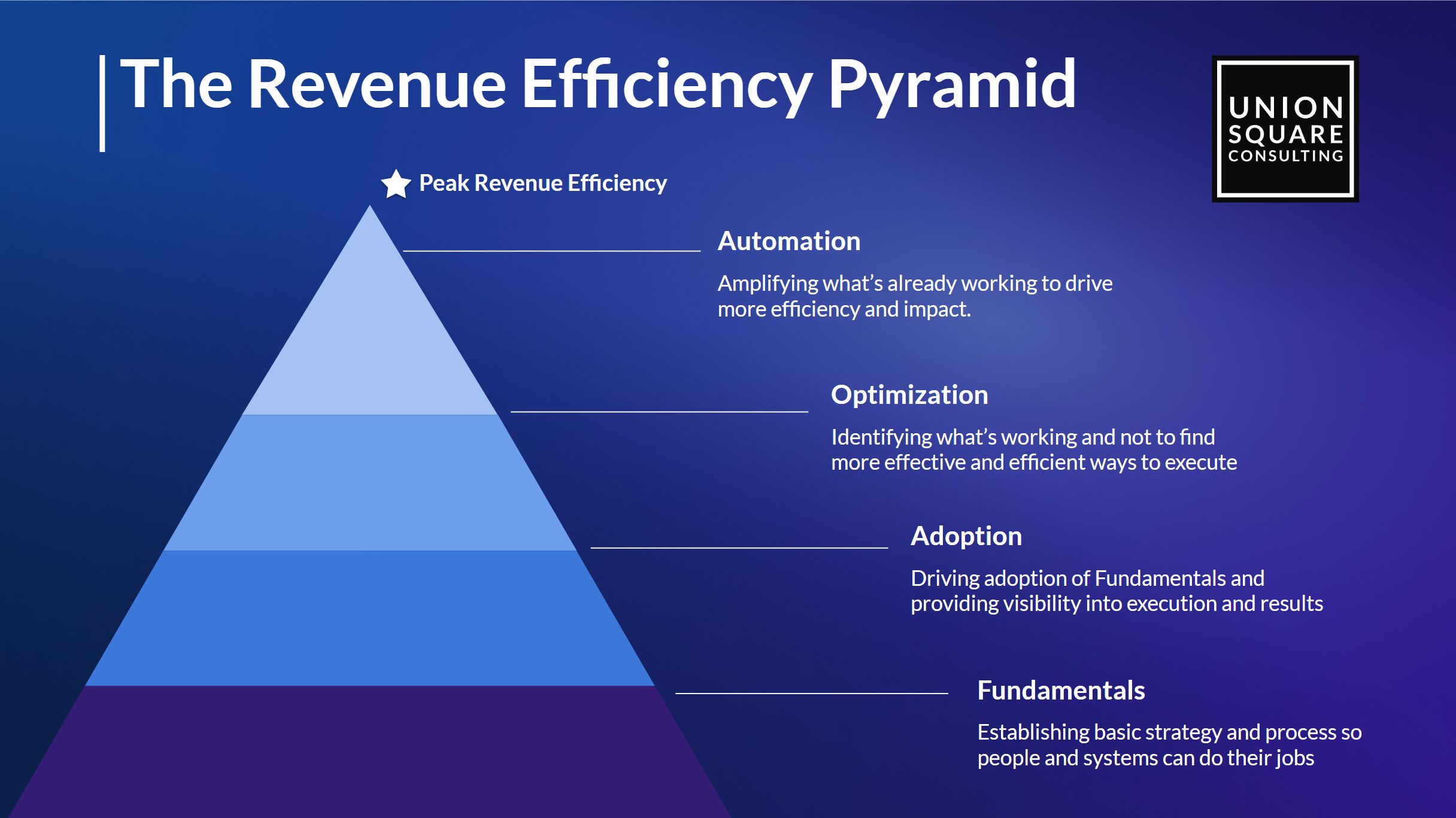

Where to Start? – The Revenue Efficiency Pyramid

Of all the things we have to do, how do we prioritize them? What can we do in the first 90 days to get some quick wins? We created the Revenue Efficiency Pyramid for exactly this reason – to help us visualize and prioritize the work to do first.

In the Revenue Efficiency Pyramid we first look at the Fundamentals. What does the team need in place to execute on the basics? What definitions and processes do they need to work inbound leads, outbound prospects, qualified new business sales, and expansion opportunities – without skipping steps or dropping balls?

Once we have the fundamentals in place, we can move on to Adoption; supporting execution of the fundamentals and creating visibility into the business.

This is as far up the pyramid as we’re going to go in this newsletter, as this is what we can realistically accomplish in the first 90 days. After that, we can work on Optimizing and Automating what’s working (and eliminating what’s not).

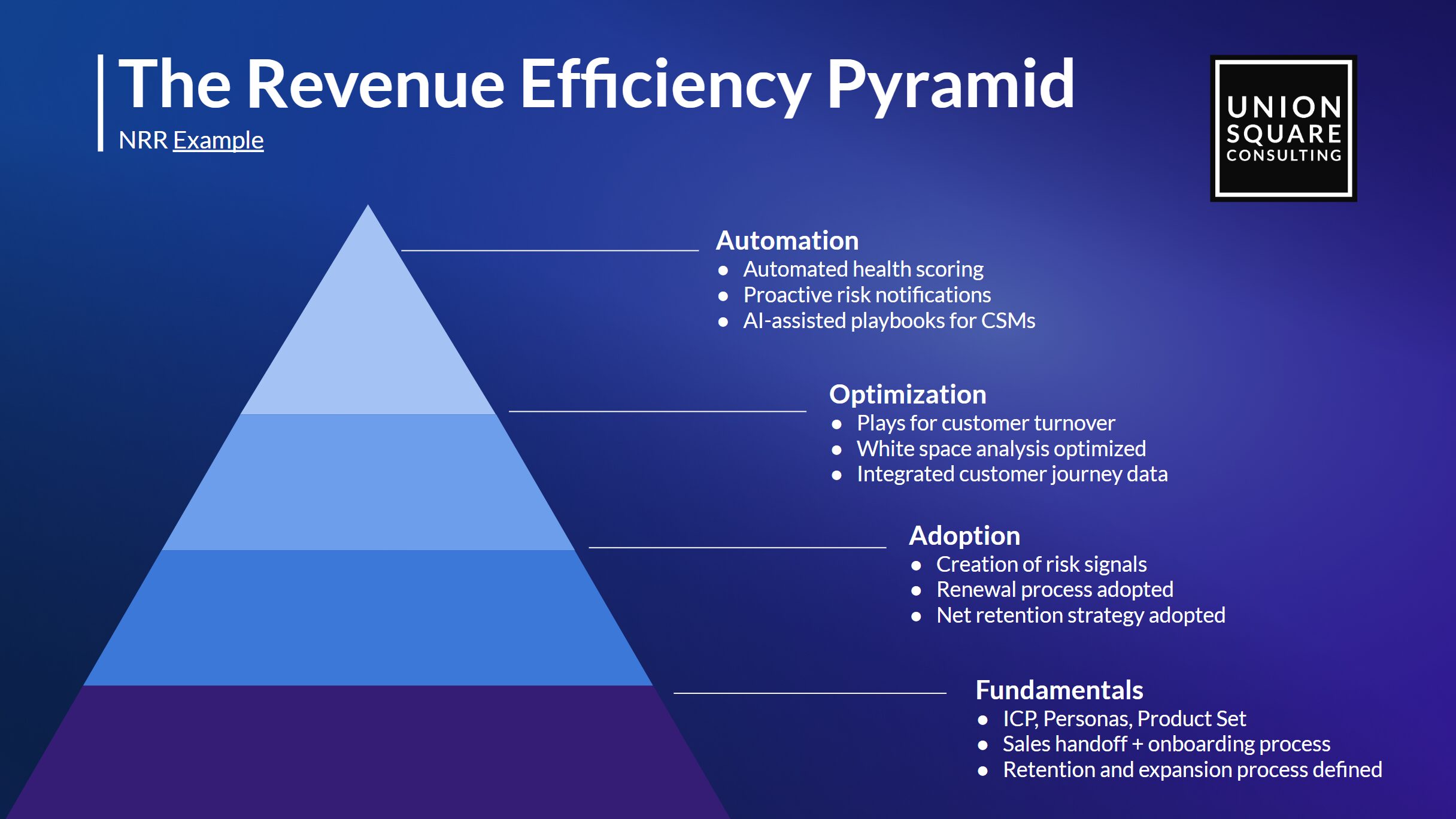

A Word on Net Revenue Retention

In the case of the three clients mentioned above, retention wasn’t a problem or a priority. But if we think there’s a bigger opportunity to generate more revenue from existing customers than new business (if churn is high, for example), we should start there.

We can find some quick wins with NRR by documenting the entire process, from ICP/Personas, to sales handoff, to implementation, to renewals and expansion. Then, we want to drive adoption of that process by creating risk signals to identify at-risk accounts and see our team executing the processes we’ve laid out to maximize customer value.

Once we have this foundation in place – which can definitely be achieved in the first 90 days – we can move on to more advanced levels to optimize NRR further.

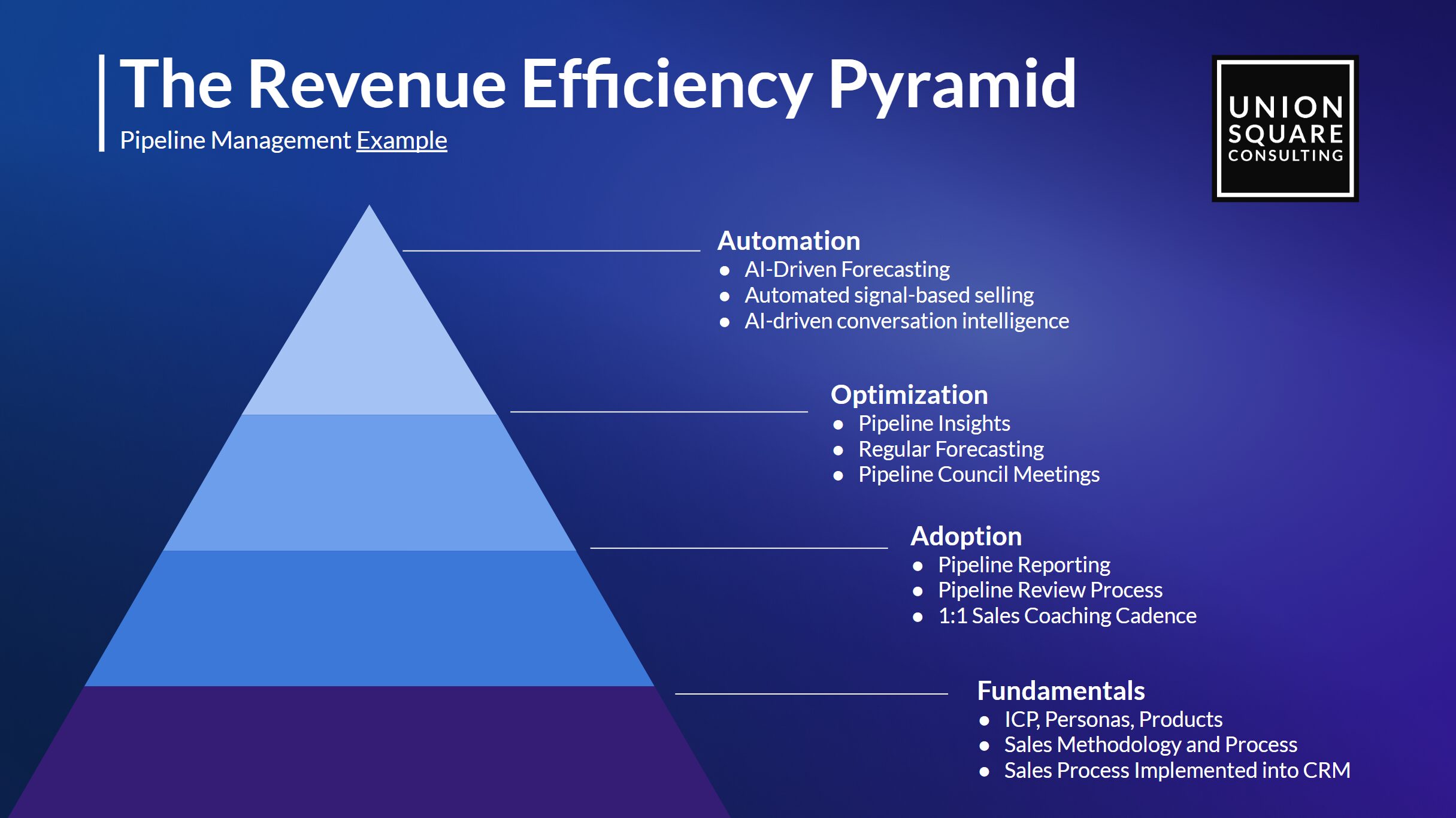

Sales Process (Pipeline Management)

When clients have the most to gain from improving new business sales, we start with the sales process. Specifically, how we qualify sales opportunities to enter our pipeline and take them through to close. There’s no point filling the top of the funnel with more leads and opportunities just to lose them in the sales process.

Fixing this first also allows us to accurately measure the pipeline generated from inbound, outbound, and/or any other channels, so we can measure what’s working and what’s not.

We take each of the three companies mentioned above through the same initial assessment:

ICP and Buyer Personas:

- Are they selling to the right people?

- Is this documented somewhere?

- Is their definition detailed enough?

- Does the entire team understand it?

If the answer is “yes” to every question, we quickly move to the next item. If not, we have some work to do.

Sales Methodology and Sales Process:

- How do they qualify deals?

- What stages do they have in their sales process?

- What is the entry criteria and process for each stage?

- Is this implemented into Salesforce properly?

We should be able to pull up a Stage 3 Opportunity and see WHY it’s in Stage 3 and what’s going on with the deal.

Reporting and Insights:

Once the above is dealt with, we build out their reporting. We’ll also create a regular process for management to use this data to review the pipeline and provide 1:1 coaching to reps.

This sets the foundation for closing deals and dramatically improves our ability to have clean, accurate pipeline, ensuring our reps aren’t skipping any steps. And yes – we do this all within the first 90 days or sooner, depending on the size of the sales team.

In two of these companies we have one sales team, so this can happen very fast. In the third we have SMB, MM, ENT, and INTL. There will be a lot of overlap but we have to get these items in order for each and every team. ICP, for example, is obviously different for SMB and ENT. The sales process likely has some nuanced differences as well.

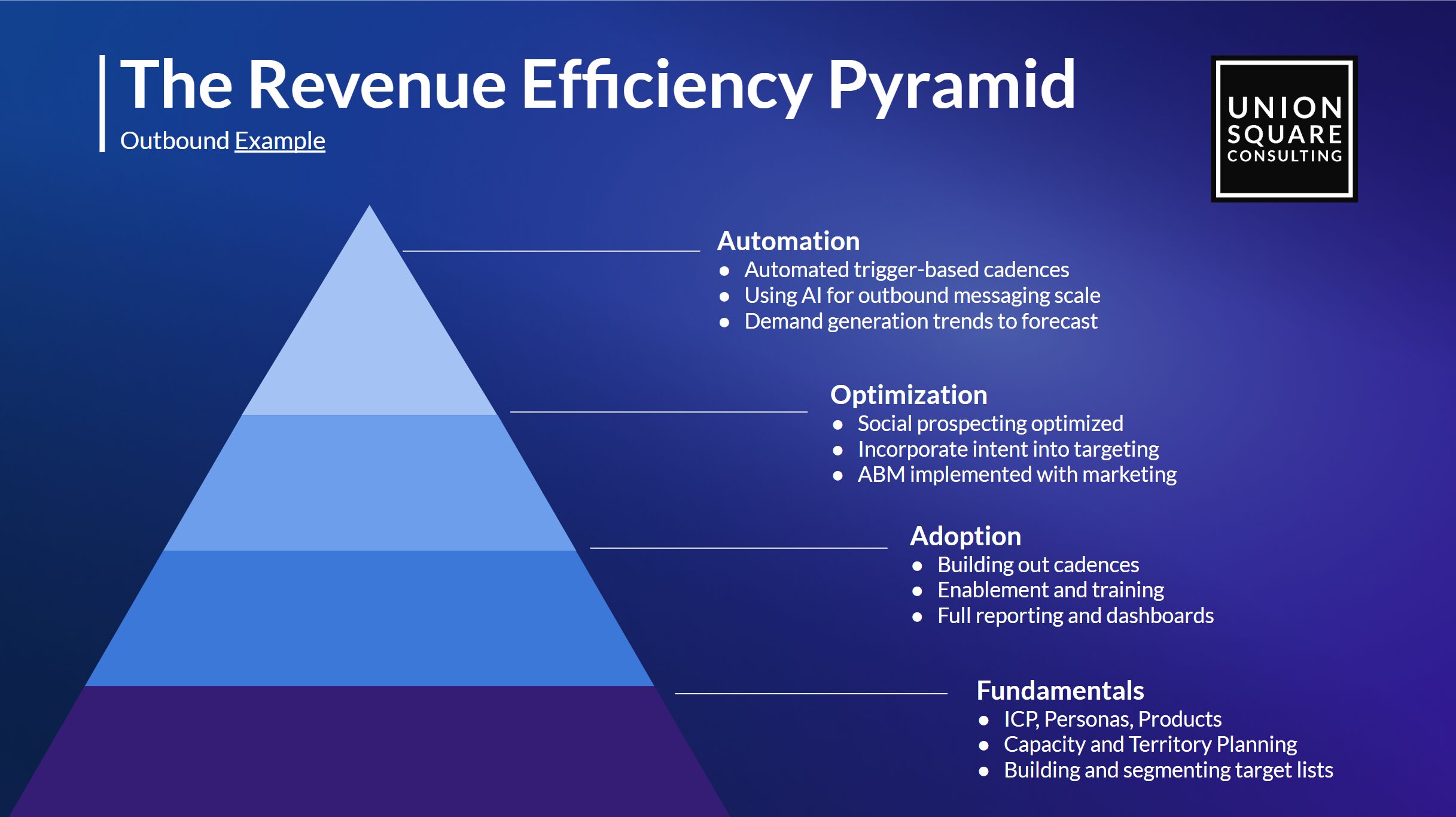

Outbound

In one company they don’t do outbound so we can skip this part. In the other two, we start by making sure we have the right ICP and Buyer Personas, as mentioned above.

Next, we want to map the outbound process and measure the capacity of each rep. How many accounts can a rep actually cover? If our reps are expected to work 5 contacts in each account via 15+ calls, emails, and LI DMs, how long does that take? How many accounts can they cover in a year, while also managing their pipeline, inbound leads, and/or expansion? This gives us a specific number of accounts for their territory plan. Then we simply need to identify the best accounts within that number. Now reps are laser focused on the right number of the best accounts.

From here, we build cadences, reporting, and dashboards and then train the team on the process. Just as outlined above, this can happen fast. This is exactly what we did when the CRO of Techstars hired us in his first 90 days.

More on our Outbound Playbook here.

Inbound

Next we come to inbound. With clear ICP and Buyer Personas in place we need to define the channels we have for inbound and the process for generating and working leads. When does a lead become an MQL, how is it routed to sales, and what is the process to work it? How do we determine where that lead came from (attribution) and how do we nurture leads until they are ready to talk to sales?

These are the basic building blocks of inbound and while some of this, such as attribution, can be extremely complex, we can get an MVP in place extremely quickly and iterate from there. In two of these companies we don’t even know how many qualified leads we’re getting and lead response time and lead management is severely lacking. Our goal is to fix this in the first 90 days before we move on to higher orders of operation.

In one company, where AEs are covering inbound, outbound, and expansion, we need to get this in place to assess how many inbound leads we can expect in order to build the right territories. An AE obviously has a LOT more time to prospect if she has ~0 leads coming inbound than if she’s getting 10 demo requests per day. Even better, an AE has a lot more time to prospect if we stop feeding her unqualified leads that aren’t even in the ICP.

Tying It All Together

In each of these examples, our CROs want quick wins. None of them are willing to wait around for 6-12 months to see results, even if we all understand that’s sometimes what it takes. So, we’re focused on the Fundamentals and Adoption stages of our pyramid for each area of GTM that’s relevant.

In the case of our AEs covering inbound, outbound, and expansion, we need to shore up each of those processes and determine how much of their time can and should be dedicated to each and build territories that focus their time where it matters most.

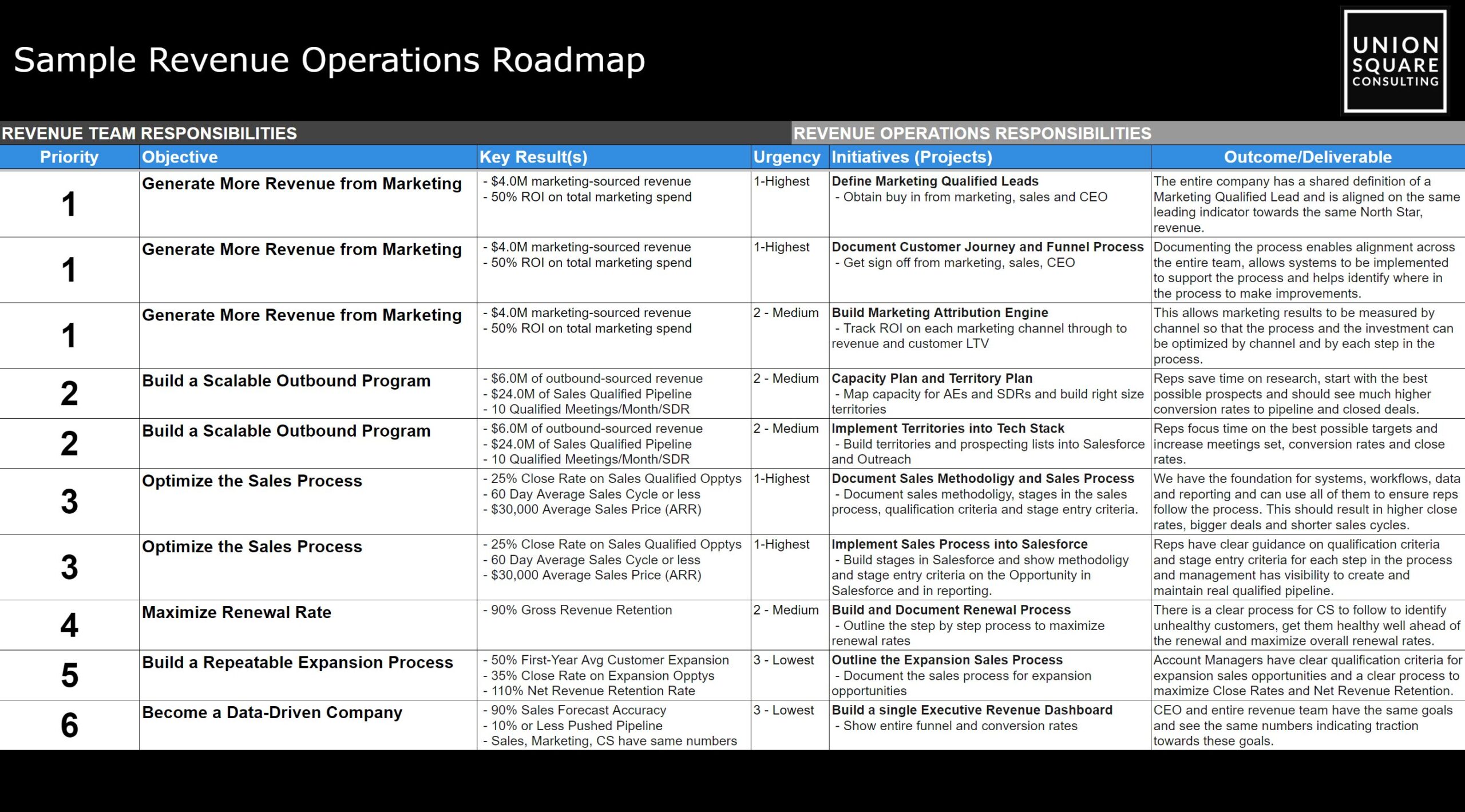

Across all three of these companies, though, we need an action plan. We need a RevOps Roadmap. In this document, we outline all the priorities we’ve identified above and match them to the Objectives and Key Results the CRO and the company want to achieve. This helps us align every person on the team with clear priorities in a single page document.

Here’s an example below. It’s worth noting this is a longer list than we’d usually tackle in 90 days but it provides common examples across sales, marketing, and CS.

More on the roadmap here.

When you’re ready, here’s how we can help:

Get a Free 1:1 Revenue Efficiency Workshop

Get one of our Senior Revenue Strategists to yourself for 1 hour and leave with a plan to increase the money-making power of your go-to-market operations.

Hire Us!

Bring us on as your Strategic RevOps Team and realize the growth potential of your revenue engine. There are 3 ways to work with us.

Get more tips like these, sent right to your inbox.

Subscribe for fresh, relevant revenue growth tips delivered every week.